Our financials

In 2023/24, our total income from lettings and sales was £73.6m, an increase from £68.4m in 2023. This growth came despite a smaller shared ownership sales programme compared to the previous year. Income from sales of shared ownership homes was £5.9m, down from £7.1m in 2022/23, representing 8% of our total turnover. This aligns with our current development strategy which is more focused on social and affordable rent. We invested £43m in developing new homes and £18.9m in maintaining and improving our existing homes, including £3.3m specifically for fire safety.

Our operating surplus reached £21.8m, up by £7.9m from last year. This increase was mainly due to the revaluation of investment properties and gains from selling fixed assets. After interest payments, the net surplus was £672,000. We have continued to face rising costs due to the impact of inflation, interest rates, necessary spending on fire safety and addressing damp and mould, skills shortages as well as the costs arising from societal pressures such as anti social behaviour, street homelessness and crime in the context of reduced public services.

This is a brief overview of our financials if you'd like to read our full Annual Accounts click here.

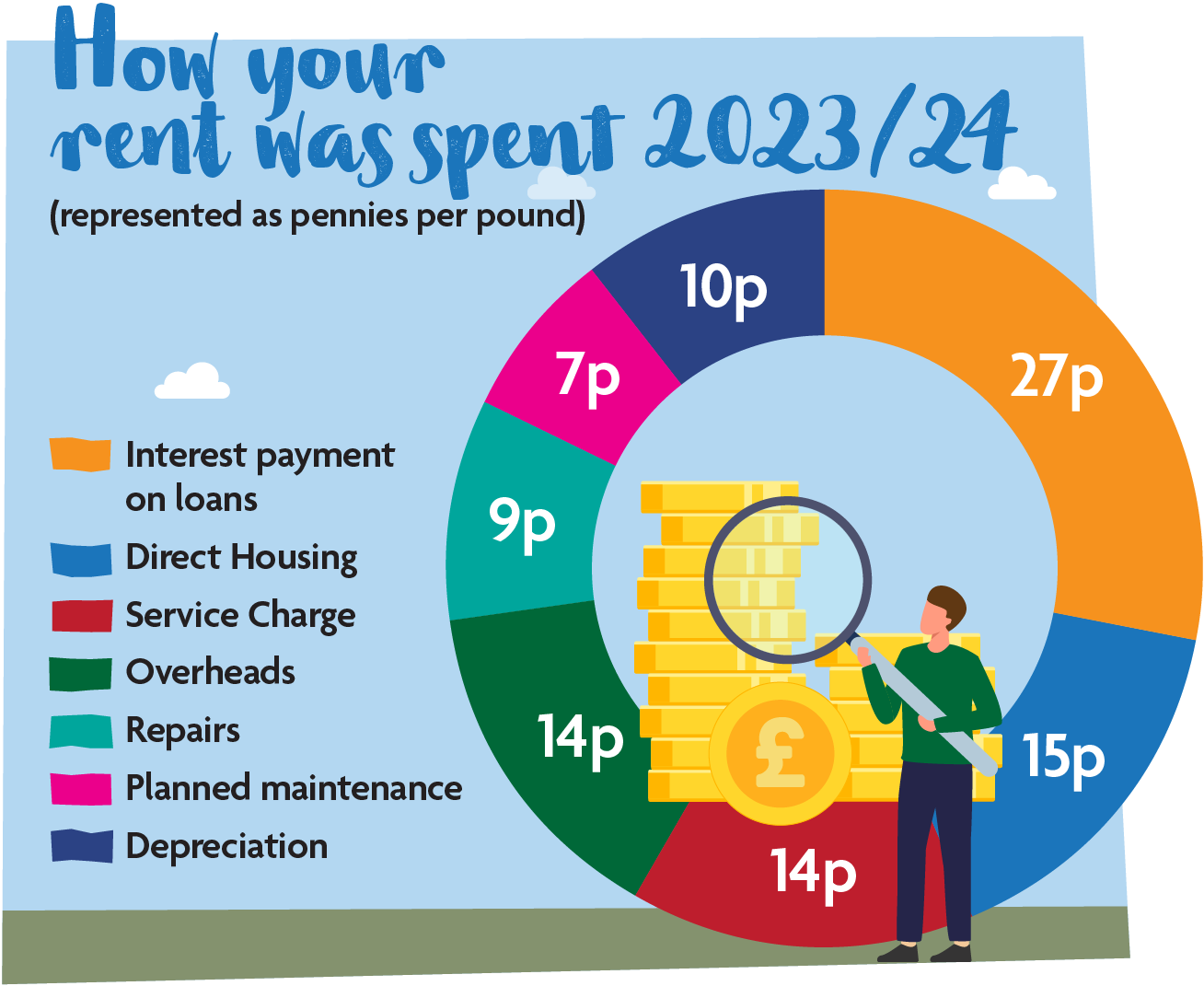

We've outlined how rent is spent and where our income comes from in the charts below

*Overheads are things like our office costs, utilities and salaries of our staff